The bad news is that fraudulent activities are rising. The good news is that ML(Machine Learning) is there to safeguard –your hard-earned assets. “As quoted by BBC Fraud Solution expert Aslam Mohammed.”

To decode this further, we’ve got to understand Machine Learning first. Machine Learning is a popular technology trend that helps in the Global Fraud Landscape—citing the threats of the growing complexity of the payment ecosystem. Fraudsters primarily attack the “path of least resistance,” which rather intensifies the need for Machine Learning.

Machine learning uses Artificial Intelligence to run software applications in the prediction of outcomes without programming needs.

Machine learning comes with versatile features – i.e., email spam detection, image recognition, and product recommendations, e.g., e-commerce sites, Business Process Automation(BPA), and predictive maintenance.

Types of Machine Learning:

Machine Learning is all about how an algorithm learns to become accurate in predictions. We can divide Machine Learning into four categories:

- Supervised Learning

- Unsupervised Learning

- Semi-supervised Learning

- Reinforcement Learning

Classical machine facilitates learning to become more accurate in its predictions.

The type of algorithm a data scientist chooses depends on which purpose & data we want to choose

- Supervised learning- Since the whole procedure is supervised in this type of machine learning supply algorithms with labeled training to assess correlations.

Data scientists supply algorithms with labeled training data in this sort of machine learning and define the variables.

- Unsupervised learning- This type of machine learning involves algorithms trained on unlabeled data. These algorithms scan through datasets seeking meaningful connections. Both the data algorithms train on, and the predictions or recommendations output is pre-managed.

- Semi-supervised learning- This sort of approach helps machine learning involve a mix of the two preceding types. Data scientists may feed an algorithm mostly labeled training data, but the model is free to explore the data independently and develop its understanding of the data set.

- Reinforcement learning. A very much popular to complete a multi-step process to define rules clearly. Popularly known as wait and watch technique.

Data scientists program an algorithm to complete a task and impart—positive or negative cues depending on the output. Whereas algorithms decide on their steps are to be taken.

Give A Glance Over- MACHINE LEARNING APP IDEAS

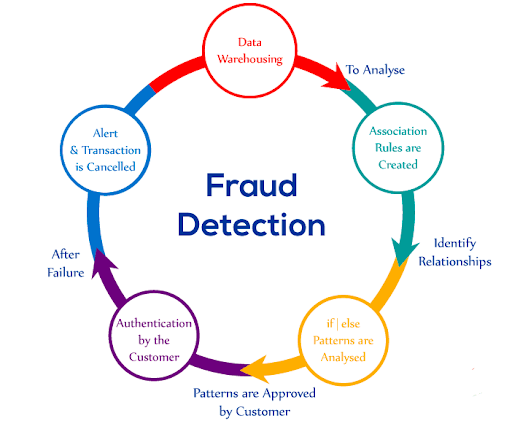

A brief description is of how machine learning works: But we are on this page to discuss ML in fraud detection.

World-cross Cyber Security has been the Talk of the Town for some years. Especially in e-commerce, the cases of cyber threats are haunting the proliferation of online business.

Despite all security mechanisms, the fraudsters can breakthrough and siphon-off. In microseconds.

So What is the remedy-the cure? Machine Learning has answers for it.

Even during the phase of COVID-19, fraudsters kept on with malicious intentions and victimized innocent subscribers in the name of donations. PHISHING was at a peak. So, I believe this will help global companies to beef up the payment gateway using the security mechanisms of ML( Machine Learning).

LET’S KNOW WHY ML features suit best for Fraud Detection :

-

Super Fast

The speed of your action plan matters if you want to clamp down on fraudsters. If you are sluggish in your approach, then in a fraction of a second, the fraudsters may barge in.

When you switch on a bulb, you don’t have to wait. It lit up at once.ML is for you as it runs several real-time analysis with thousands of queries while comparing the outcome to the best results. It hardly takes milliseconds.

It always remains in the process of queries to find the best results. It helps analyze customer’s behavior so as when an anomaly arises, one could block or flag a payment for review.

-

Scalable

The thriving online business helped companies to increase the transaction volume. With a rules only system, increasing the amount of payment and customer data puts more pressure on the rules library to expand. Nevertheless, in machine learning, it’s the opposite – more data is better.

To put that in metaphor, ‘A 500 CC motorbike(bullet) gives more efficiency when it covers long distances’.

The machine learning system improves more massive datasets because it is a mixed bag. Good & bad e.g. both genuine and fraudulent customers. It means the model can pick out the differences and similarities between behaviors more quickly and forecast fraud in future transactions.

-

Accuracy

Breaking into non- intuitive patterns or subtle trends is not that easy for humans. ML can form new ways together. And we know fraud analysts are known to do this.

Machine Learning interprets normal behavior better. So when it sees any malicious activity, it raises a flat. It helps in identifying a network when there is no chargeback yet. It helps identify suspicious signals. It is giving a fair idea about copying and pasting information.

Related Blog: HOW MACHINE LEARNING DEVELOPMENT CAN ACT AS A BARRIER FOR COVID-19 AND OTHER PANDEMIC DISEASES

The features facilitate Unsupervised learning In Fraud Detection Algorithm.

No Surprises if fraud is any abnormal activity or behavior. Unsupervised learning helps in self-learning in finding hidden patterns in transactions. It involves self-learning in finding remote and unveil fraud patterns.

How Unsupervised Machine Learning Works?

This type of machine learning algorithm doesn’t need labeled data. Unsupervised machine learning algorithms do not require the labeling of data. They sift through unlabeled data to look for patterns used to group data points into subsets. Most types of deep learning, including neural networks, unsupervised algorithms.Unsupervised learning algorithms better suits for the following tasks.

- Clustering. Splitting the data set into groups for reality.

- Anomaly detection. Identifying unusual data points in a Data Set

- Association mining. Identifying sets of items in a data set randomly occurs in a bundle.

- Dimensionality Reduction. Variables are reduced in Data Set

Source: xenonstock.com

Possible Channels

- High Traffic of new transactions e.g. a customer adds new 10 payment cards in an hour

- A consumer placing lots of orders of high-value goods e.g., luxury alcohol, expensive apparels

- Phishing, e. technologies. email addresses a mismatch between the account name or cardholder name, or rude/profane words or threatening words

- Orders received from a particularly from an unknown location, shipping to a known fraud hotspot or a PO Box rather than regular residential address

Such examples are flagged as high risks- so what happens when the machine makes a prediction?

- Input Data

- Extract Features

- Train Algorithm

- Create a Model

1) Input data

The technique of Fraud Detection thrives if there is more data.

In the process of supervised machine learning, the data can either be segregated into good (genuine customers who have never committed fraud) and wrong (customers with a chargeback associated or labeled as fraudsters).

2) Extract features

It describes customer behavior & pattern, while fraudulent actions are known as fraud signals.

We categorize features into five main categories, with hundreds or thousands of individual characteristics:

- Identity: Essential details like Number of digits in the customer’s email address, the validity of a/c, number of devices the customer used, fraud rate of customer’s IP address.

Failed transactions, average order value, risky basket contents in the initial weeks

- Payment Methods: Fraud rate of issuing banks, the similarity between customer name, name, cards from other countries.

- Locations: Shipping address communicates to match the billing address; shipping country reaches the country of customer’s IP address and the threat of fraud at customer location.

- Network: Frequencies of emails, phone no. or payment methods shared within a network, customer’s network.

3) Train Algorithm

Solving a complex problem requires an algorithm— a set of rules. For example, they are solving mathematical equations or programming tasks. It uses customer data described by features to make predictions, e.g., fraud/ not fraud. In the beginning, this data is used on algorithms: an online seller’s historical data called a training set.

The more fraud in this training set, the better so that the machine has lots of examples to learn from.

4) Create a Model

Once the training is done you have a business-specific model by which you can detect fraud in a millisecond. Keeping a vulture eye on the model to make sure it is behaving as it should, and it is improving. It helps improve, update, and upload a new model for every client in the system will always keep an eye on new duping techniques.

Related Blog:TOP 7 MACHINE LEARNING APP DEVELOPMENT COMPANIES SUPPORTING SME & ENTERPRISES ML ADOPTION

How can you tell if the model is Working?

Once training is done you can check if the model is working correctly, contains some data which has never appeared to know the fraud outcomes. The model diagnoses the fraud accurately, deploys it to detect online business’ transactions. Automatic common-sense analysis on recent dates demonstrates no fraud labels to ensure if the model is working fine.

There are certain frauds situations which help in choosing the model – here is the list of examples:

- Redundancies of new payment methods e.g. a customer adds 10 new payment cards in an hour.

- A customer is showing signs of orders of high-value goods e.g. luxury alcohol, expensive apparel.

- Orders raised from a suspected location, shipping to a known fraud hotspot or a PO Box rather than a residential address

These mentioned examples are flagged as fraud – so what happens when the machine makes a prediction?

Conclusion

With Machine Learning, we now have more avenues to clamp down malicious activities in making digital payments. With a specific mechanism, one may reinforce the payment gateway while adding layers of security.

If you’re looking for top IT companies in India, then you can choose ValueCoders to rent a coder or hire Machine learning app developers. It is one of the leading names in the AI and ML application development industry who provide world-class Machine learning apps to boost your business success.